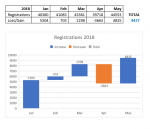

So from the revised figures there are more than double the number of new registrations to new company registrations. Despite a drop of 10% it still shows a clear sign that the average AU consumer, is still choosing to register .com.au names and has no idea about the what is going on in the space, and with those numbers they are still able to register their domain names.

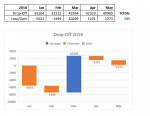

Yes, in isolation domain registrations are double Company Registrations. However, when determining the overall net gain to the domain registration market over the past 6-months we should also calculate the drop off rate [expired domains] as part of that stat;

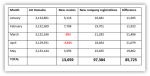

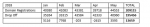

the table above was the original calculation - subtract drop-off from registrations to get the net loss/gain.

The revised table provided doesn't look so pretty. Over 6 months - A total net gain of

9,622 New domain registrations compared to

97,384 New company registrations. obviously, the new company registration stat has not factored, external administration (EXAD). Appointments which total approx. 3,000 for this time period [its minimal] or voluntary de-registration [unknown] domain registration should be way more, right?

To solidify this argument;

https://www.auda.org.au/assets/Policies/panels-and-committees/2017PRP/registrantissuespaper/Scott-Long-March-2018.pdf

https://www.auda.org.au/assets/Policies/panels-and-committees/2017PRP/registrantissuespaper/Scott-Long-March-2018.pdf

Keep in mind, the ABR maintains a restrictive naming allocation process; unlike domain name registration which accommodates name

creativity beyond the ABR company name registration policy. This means, the domain naming registration process is more flexible and should produce

more registration opportunity for Companies, especially new Companies that are heavily restrict by the ABR naming process. So, why are these registrations low, why is the net gain to the Domain Registration Market compared to Company Name registration disproportionate? In my opinion, auDA has not provided the necessary promotion, education, and investment in this market, it has not found policy outcomes to support the aftermarket, focused on their own commercial aims, and pulled support from community programs and industry grants. Arhhhhhhhhhhh…..

The Aftermarket has definitely seen huge drops in consumer confidence. The prices are just not there, the demand is not there, the number of drop bids on Drop and Netfleet are at a record low. So this is the space that is currently most affected.

Why? My short answer to this question stems from auDA abusing its power by deliberately suppressing the Aftermarket. It’s made obvious by the interim PRP policy recommendations and expression within these recommendations contain an almost spiteful attitude against domain investors. As you know, the aftermarket is the investment arm to the domain registration market, a trading platform critical for the optimization of the market sectors it interacts with. And, as a registrar you would have already identified within its report that the majority of recommendations are very resistant to domain investment. [focused on allocation to non-economic minorities]

At Drop after we complete our migration and new site, the Aftermarket auctions will resume and we will be working hard to promote the aftermarket to end buyers and rebuild the stability and confidence of the space. As at the end of the day that is all what we want.

We all want that David, if only auDA wanted the same; drop auctions such as you provide keep the engines running. One day I hope auDA will support you and others in bringing about heightened awareness about the aftermarket via funded programs.

cheers