Scott.L

Top Contributor

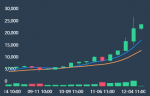

Price surging on news of official start to futures by CME and CBOE

Derivatives marketplace operator CME Group will launch a bitcoin futures product on December 18, ending speculation as to when the much-anticipated offering would be available in the U.S.

In a press announcement, CME said it has self-certified the initial listing of the product and that it has received approval from the U.S. Commodity Futures Trading Commission (CFTC) to do so. The reveal comes just weeks after CME indicated via its website that it would launch the product on December 11, before retracting the remarks.

The cash-settled contracts will find investors buying exposure to a custom reference rate created by CME and partner Crypto Facilities, and will not require the custody of the asset. The rate uses data from exchanges including Bitstamp, Kraken, itBit and GDAX.

Still, at launch, Duffy explained the bitcoin futures product will be subject to risk management tools, including a margin of 35 percent, position and intraday price limits.

https://www.wsj.com/articles/bitcoi...ars-of-manipulation-hacks-glitches-1512907201

Derivatives marketplace operator CME Group will launch a bitcoin futures product on December 18, ending speculation as to when the much-anticipated offering would be available in the U.S.

In a press announcement, CME said it has self-certified the initial listing of the product and that it has received approval from the U.S. Commodity Futures Trading Commission (CFTC) to do so. The reveal comes just weeks after CME indicated via its website that it would launch the product on December 11, before retracting the remarks.

The cash-settled contracts will find investors buying exposure to a custom reference rate created by CME and partner Crypto Facilities, and will not require the custody of the asset. The rate uses data from exchanges including Bitstamp, Kraken, itBit and GDAX.

Still, at launch, Duffy explained the bitcoin futures product will be subject to risk management tools, including a margin of 35 percent, position and intraday price limits.

https://www.wsj.com/articles/bitcoi...ars-of-manipulation-hacks-glitches-1512907201